Another day, another documentary. Actually, this is one I’ve seen several times and read the book too, simply because it richly deserves the attention.

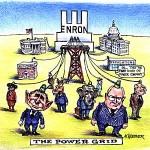

The Smartest Guys In The Room tells the story of the rise and fall of Enron, the apogee of all that was and is bad in Capitalism, but at the time a company that was praised to the skies by traders, politicians, management gurus and everyone else.

How could it all go so badly wrong? The answer is analysed here in systematic detail. The essential answers are these:

- Taking a business built by chairman Ken Lay around rock-solid supplies of energy and turning it into a trading organisation to bump up the price, regardless of the impact on customers, tells you that sooner or later people will be sacrificed to the altar of eternal growth.

- If you have American politicians in your pocket, and associate with them for long enough, you have their de facto endorsement and credibility rating. By association, you are trusted.

- If you believe your own hype and spread it with evangelical zeal, markets and analysts, get carried along for the ride: the rise in share price becomes a self-fulfilling phenomenon, even when the books have to be cooked to demonstrate the relentless growth.

- Company lawyers and accountants, and even management gurus like Gary Hamel fell victim to the company hype.

- The Financial Director also created toxic and highly illegal networks of offshore companies to hide losses, boost company share price and line his own pockets, but was allowed to get away with it almost unquestioned.

- At the same time, allowing directors to get away with selling millions of dollars in stocks because they knew the company would crash, is fraud and insider trading on a massive scale.

- Conversely, it took a journalist to spot the flaws in the balance sheet and profit/loss data, but she was roundly derided for her pains. When you point to the emperor’s new clothes, you earn ridicule for not having faith, thanks to the massive Enron PR machine spinning the truth while revealing almost nothing of the reality.

- Booking profits immediately on the basis of presumed value of a contract breaks every known law in accountancy – yet here Jeff Skilling was allowed to get away with it, apparently without challenge.

- Creating an adrenalin-fuelled macho culture where failure is not tolerated and the worst performing 10% are fired each year means nobody can ever own up to under-performance.

- This hyper-competition results in traders resorting to all manner of underhand and deceitful practices to ensure they are up there with the top performers. In Enron, it seems there was nobody in the management hierarchy prepared to stop

- Sooner or later, the market will fall – and here it came in a spectacular fashion as the company ran out of cash. The bubble burst, because it contained no substance.

Credit then to director Alex Gibney and cowriters Bethany McLean (the journalist who broke the original story Is Enron Overpriced? and cowrote the original book) and McLean’s Fortune colleague Peter Elkins for developing what in practice was a fiendishly complex web of deceits into a gripping detective story, where each stage of the unpeeling of the onion provides salient facts without ever sacrificing accessibility. This includes the role of the authors in pursuing the case against Enron, veering the tale in the direction of gonzo journalism, but none the worse for that.

Some of the minor examples of Enron psychology are fascinating, such as when a highly stressed Skilling, allegedly close to a nervous breakdown but still participating in a call to industry analysts, answered a piercing question from one by calling the questioner an “asshole.” Maintaining the smoke and mirrors took its toll on the key players, yet the inevitability of the collapse was the elephant in the room, the one thing that could never be discussed under any circumstances.

Some of the top brass, like Lou Pai, escaped with huge fortunes and apparently without criminal proceedings before the wheels came off the bus. Others, including Sherron Watkins, became whistleblowers and participants in the film. At least one senior executive, Cliff Baxter, committed suicide before he could testify before Congress.

You wonder how this could ever be allowed to happen, though the 2008 recession and the bankrupting of banks tells you that companies can still hide the truth and leave it to others to pick up the pieces. The answers are talked up by politicians:

- Pre-recession, regulation was uniformly lax – even more so in the US than in the UK, but also throughout the civilised world.

- Nowadays nobody would be allowed to deceive financial regulatory bodies or politicians, particularly for insider trading or misrepresentation.

- Disclosure rules are more closely adhered to, with greater punishments for transgressors.

- In hindsight, trading companies are more ethical and have built up stronger internal compliance departments with strong Chinese walls.

- And so on…

Are you convinced? The repeated denials and claimed innocence by ex-Enron executives tell you one thing: whatever is going on behind the scenes, few if any will own up and tell you what they are really doing. If you blindly accept any gospel, you will end up being deceived.